XRP hits new all-time high after seven years as market cap tops $200B

Key Takeaways

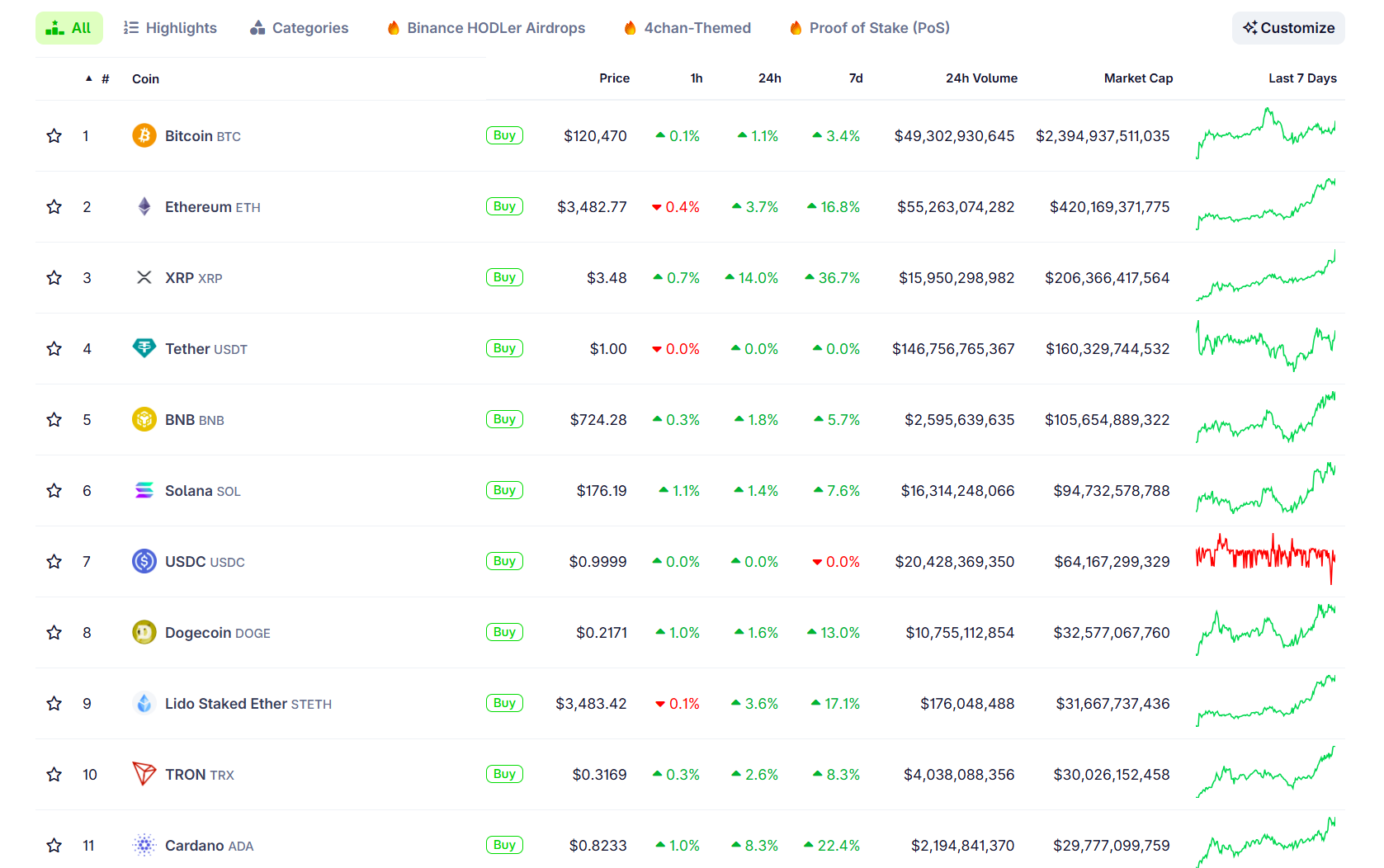

- XRP reached a new all-time high of $3.5 and its market cap surpassed $200 billion.

- The surge in XRP’s price was driven by US legislative progress on crypto and anticipated regulatory developments.

Share this article

XRP surged 14% in the past 24 hours to reach a new record high of above $3.5, pushing its market capitalization to $206 billion and reinforcing its position as the third-largest crypto asset, according to CoinGecko data.

The digital asset has outperformed Bitcoin over the past week, climbing more than 35% while Bitcoin gained around 3%.

Why is XRP up today? GENIUS Act passes, Trump eyes crypto 401(k)s

GENIUS Act to become law

The price rally follows the passage of the GENIUS stablecoin bill in the US House and a report that President Trump plans to issue an executive order allowing crypto assets and other alternative investments into the US $9 trillion retirement market.

XRP began its upward movement on Wednesday as the House passed a resolution setting terms for debate on three crypto bills – the GENIUS, Clarity, and Anti-CBDC acts. The token pushed past $3 after the rule was adopted.

Momentum accelerated on Thursday as the House passed the GENIUS Act, which is especially relevant to Ripple’s stablecoin ambitions. The legislation establishes a federal regulatory framework for payment stablecoins, mandating full reserve backing, regular audits, and licensed issuance.

Ripple has already positioned RLUSD to meet these requirements, including applying for a national trust bank charter, seeking a Fed master account, and securing BNY Mellon as a qualified custodian for reserves.

With the GENIUS Act set to become law, the regulatory clarity it provides is expected to accelerate adoption of RLUSD, potentially giving Ripple a first-mover advantage in the regulated stablecoin sector.

Trump eyes opening US retirement market to crypto

Shortly after the House passed the GENIUS Act, along with the CLARITY and Anti-CBDC bills, the Financial Times reported that President Trump is considering signing an executive order this week to open the $9 trillion US retirement market, including 401(k) plans, to crypto assets, gold, private equity, and other alternative investments.

According to the report, the executive order would instruct regulators to identify and remove barriers that currently prevent these asset classes from being included in professionally managed retirement portfolios.

The news sparked a broad rally across crypto markets. Bitcoin edged closer to $121,000, Ethereum reclaimed $3,500, and XRP broke past $3.4.

XRP was trading close to $3.5 at the time of reporting.

What’s next for XRP?

All eyes are on the long-running SEC v. Ripple case, which is nearing full resolution. Both parties are expected to withdraw their appeals for the case to be completely resolved.

Ripple CEO Brad Garlinghouse recently confirmed the company plans to drop its cross-appeal to bring the legal fight to an end and shift focus to execution and growth.

Industry observers are also keeping tabs on the potential approval of US-listed spot altcoin ETFs, including those tied to XRP.

Just as spot Bitcoin ETFs have unlocked billion-dollar institutional inflows, an XRP ETF could attract interest from wealth managers, retirement funds, and registered investment advisors (RIAs), once regulatory barriers fall.

Share this article