Keiser Says Stablecoin Issuers Buy BTC for Free

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as we discuss the growing influence of stablecoin issuers in the US Treasury market. With growing institutional adoption and regulatory legitimization of US dollar-pegged stablecoins, experts warn of artificial inflation of demand for the dollar.

Crypto News of the Day: Using Government Debt Instruments To Back Digital Dollars is Risky, Keiser Warns

The influence of stablecoin issuers in the US is growing, so much that Tether, which already issues the USDT stablecoin, plans to launch a US-only stablecoin by 2025. Tether aims to position stablecoins as strategic financial tools under the Trump administration.

This chart shows Tether’s dominance in the stablecoin market, with overall supply going from $2 billion to more than $200 billion in recent years.

Meanwhile, the US Treasury projects stablecoins could reach a $2 trillion market by 2028, which could attract more players.

Nevertheless, as stablecoin influence in the Treasury market grows, the House Financial Services Committee is concerned.

BeInCrypto reported lawmakers questioning US Treasury Secretary Scott Bessent about Trump-affiliated World Liberty Financial (WLFI) and its new USD1 stablecoin.

Perhaps, however, the greater concern is stablecoin issuers’ using Treasury yields to buy Bitcoin. According to experts, this could undermine US government reserves.

A recent US Crypto News publication indicated reports of stablecoin issuers using Treasury yields to buy Bitcoin. Some say this could undermine initiatives like the proposed US Strategic Bitcoin Reserve, which aims to bolster national holdings of the pioneer crypto.

Growing Influence of Stablecoin Issuers in US Treasuries Market is Concerning, Max Keiser Says

Among them is Bitcoin pioneer Max Keiser, who voiced concerns over the growing influence of stablecoin issuers in the US Treasury market. Keiser warns that their use of government debt instruments to back digital dollars may have broader implications for the global financial system.

As of Q1 2025, Tether reported holding nearly $120 billion in short-term US Treasury securities and reverse repos. This makes it one of the largest non-sovereign holders of American government debt.

Meanwhile, Circle, issuer of USDC, disclosed more than $22 billion in Treasury bills in a February 2025 attestation.

These holdings collateralize dollar-pegged stablecoins, helping issuers maintain liquidity and trust. The issuers benefit from the interest income generated by the bonds.

While this practice is common and legal, Keiser contends it contributes to deeper systemic issues tied to fiat currency dynamics.

“This is exactly why the stablecoin issuers are buying Bitcoin, this is called a speculative attack on the US dollar. Feeding the debt spiral with fiat stablecoins, buying treasury bills, and then investing the interest into Bitcoin, allowing the stablecoin issuers to buy billions in Bitcoin for free,” Keiser told BeInCrypto.

Stablecoin issuers purchase US debt on secondary markets and earn interest, which they may or may not deploy into digital assets like Bitcoin. Keiser is critical of the broader financial architecture underpinning stablecoins.

“Issuing new stablecoins backed by US T-bills printed out of thin air is not a monetary system, but a financial hologram,” he said.

US Treasury bills are debt instruments issued by the federal government and sold to investors, including private companies like Tether and Circle, through regulated markets. These stablecoin issuers tokenize existing fiat currency held in reserve.

Keiser elaborated on what he sees as the long-term consequences of this model.

“It’s a speculative attack by private banks. It is financial repression, pushing rates down as ‘malinvestments’ increase. It is rinse and repeat,” he explained.

His critique also extends to the broader outlook for the US dollar, which, according to the Bitcoin pioneer, “is a quick, deadly fix; a USD hospice. Cue the final death throes of the US dollar.”

BeInCrypto has contacted Circle and Tether for comment and will update this article if they respond.

Max Keiser Proposes AI To Invent Novel Security Structures

Keiser also highlighted what he views as an emerging trend. He said high-profile investors and technologists use artificial intelligence (AI) and novel corporate strategies to increase Bitcoin exposure.

The Bitcoin maxi referenced Strategy Executive Chair Michael Saylor and investor-turned-politician Vivek Ramaswamy.

“Financial engineers like Michael Saylor and Vivek Ramaswamy are using AI to invent novel security structures to maximize the Bitcoin Treasury model. Vivek Ramaswamy plans to take his company, Strive Asset Management, public by merging with Asset Entities and starting to accumulate Bitcoin using the model that Saylor’s Strategy has already successfully adopted — using proceeds from stock and debt issuance,” Keiser remarked.

Though no confirmed public filings detailing Ramaswamy’s use of AI in this context, Keiser sees these developments as significant.

“The results are redefining finance globally and adding significantly to the Bitcoin demand. OG’s like myself, who have watched Bitcoin outperform everything for 15 years, are seeing, for the first time, investment strategies that are outperforming Bitcoin, and the implications are profound,” he said

Keiser believes such strategies could push Bitcoin’s market value even higher. He also implied that the extraordinary compounding rates of the past could be extended. This sentiment comes as Bitcoin captures more of the total addressable market and scales even higher price points.

The views expressed are those of Max Keiser and do not necessarily reflect the opinions of BeInCrypto.

Chart of the Day

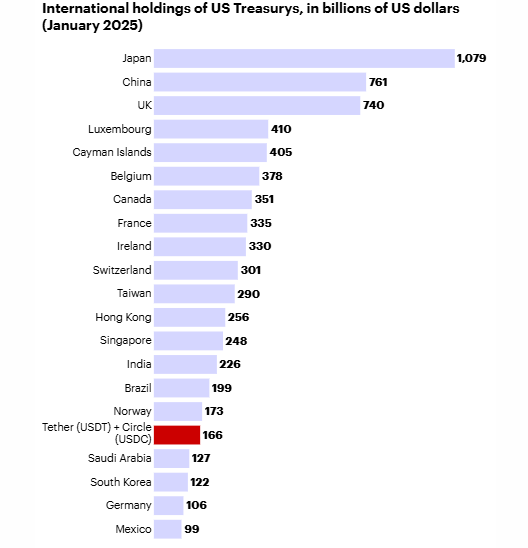

This chart shows that stablecoins have become a large holder in US treasuries.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Bitcoin faces heightened volatility as US-China trade talks in Switzerland risk failing, potentially triggering sharp price swings.

- OCC confirms banks can buy, sell, and hold crypto assets at customer request. Services include trade execution, recordkeeping, valuation, and tax reporting.

- Standard Chartered predicts Bitcoin could surpass its all-time high soon, driven by surging ETF inflows and capital movement.

- Bitcoin has seen over $1 billion in daily inflows, signaling strong demand and potentially paving the way for a price surge toward $105,000.

- Bitcoin spot ETFs saw major inflows and outflows this week, driven by investor reactions to macroeconomic shifts and the Fed’s rate decision.

- Solana launchpad Pump.fun surged past Tron with $2 million in daily revenue, ranking third globally behind only Tether and Circle, per DefiLlama.

- Ethereum’s Pectra upgrade has triggered a surge in network activity, lowering the circulating supply to an 18-day low of 120.69 million ETH.

Crypto Equities Pre-Market Overview

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.