Expert Slams XRP Lawsuit Delay Rumors: ‘2026 Not Happening’

Talk of the US Securities and Exchange Commission’s long-running enforcement action against Ripple Labs dragging on into 2026 flashed across X over the weekend, after the pseudonymous trader “Altcoin Bale” warned followers that “SEC v XRP final decision could be delayed until late 2026” — a claim that ricocheted through crypto-X in minutes.

Within hours, Australian solicitor and veteran XRP commentator Bill Morgan counter-punched. “This is not on the cards unless Judge Torres rules against the latest joint motion and rather that make the common sense decision to live with the summary judgement decision and the current penalty and permanent injunction, the settlement process breaks down completely and both parties run their appeals. An improbable outcome.”

XRP Lawsuit: Why 2026 Is A Stretch

Morgan’s confidence rests on hard procedural facts. On 13 June Ripple and the SEC filed a joint Rule 60(b)/62.1 motion asking Judge Analisa Torres to dissolve last year’s injunction and redistribute the $125 million civil penalty now sitting in escrow — $50 million would satisfy the SEC; the remaining $75 million would be returned to Ripple.

The filing also proposes that, if Torres signals she is inclined to grant it, both sides will seek a limited remand from the Second Circuit so the district court can enter a revised final judgment and terminate all appeals.Critically, the Second Circuit has already paused those appeals and ordered the SEC to file a simple status report by 15 August 2025. That administrative date — now being mis-read as a litigation deadline, doesn’t mean the final decision will take until 2026.

Judge Torres’ July 2023 summary-judgment split the case, holding that institutional sales of XRP were unregistered securities offerings but programmatic exchange sales were not. After remedies briefing, she entered a $125 million penalty and a permanent injunction in August 2024. Both sides noticed appeals, but in March 2025 the SEC withdrew its challenge to the programmatic-sales ruling and signalling a broader retreat from crypto-first enforcement. The parties then began settlement talks that produced the current joint motion.

The renewed request goes further than the May version Torres rejected for procedural defects: it lays out “exceptional circumstances” — chiefly, the policy shift at the SEC and the parties’ mutual interest in ending the litigation — that courts require before modifying a final judgment under Rule 60(b)(6). If Torres issues the “indicative ruling” the motion seeks, the case would likely return to her docket on limited remand and close swiftly without full appellate briefing.

Morgan concedes that total settlement failure is “not impossible.” If Torres were to deny the joint motion and decline to dissolve the injunction, both sides would revive their cross-appeals. That procedural reset could indeed postpone a conclusive ruling into late 2026 — but only under that narrow, two-step scenario he deems “improbable”.

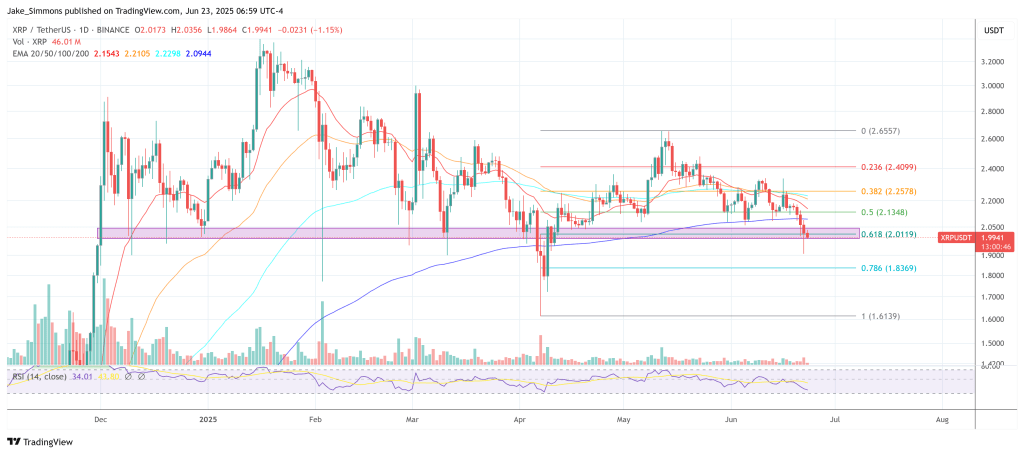

At press time, XRP traded at $1.99.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.