BitMine Buys Ethereum Dip; Is ETH Price Ready for $10k?

BitMine has bought the Ethereum (ETH) dip amid heightened fear of further capitulation. According to on-chain data analysis from Arkham, BitMine purchased $300 million worth of Ether since last week, amid the recent market correction.

BitMine Leads in High Demand for Ethereum

Following its latest purchase, BitMine now holds Ether valued at about $12.4 billion at the time of this publication. The company’s Ether accumulation coincided with a rising demand for altcoins by institutional investors.

According to a weekly report from CoinShares, Ethereum’s investment product registered a net cash inflow of about $57.6 million. Meanwhile, at least 15 entities hold 4.75 million ETH as a form of treasury management led by BitMine and SharpLink.

Is ETH Price Ready for the Euphoric Phase of the 2025 Bull Market?

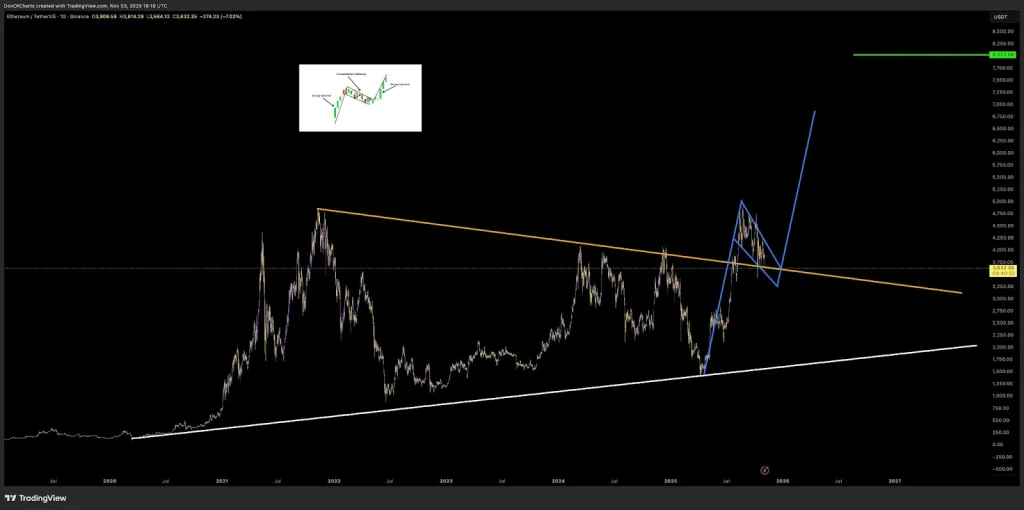

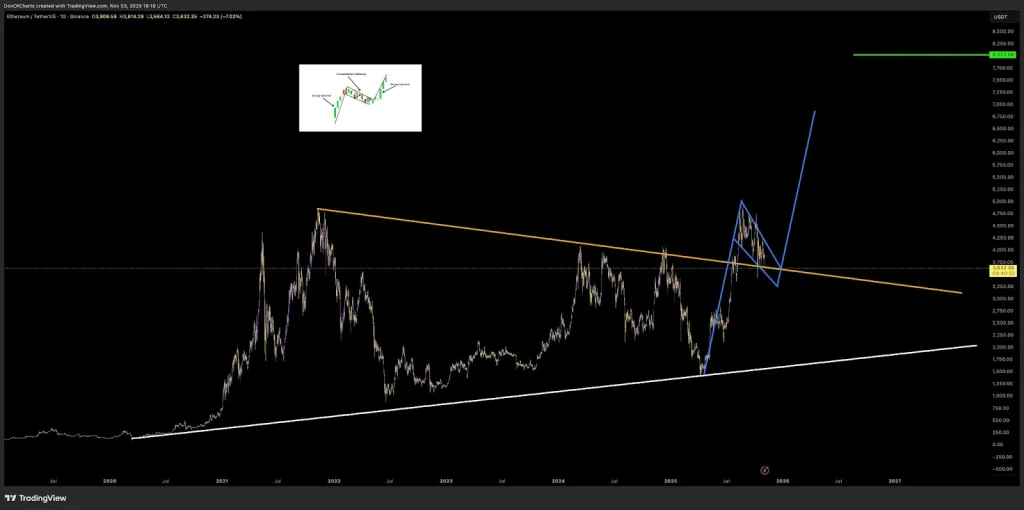

From a technical analysis standpoint, it is evident that Ether price is in the early phase of the macro bull market. The large-cap altcoin, with a fully diluted valuation of about $434 billion, has been retesting its bullish breakout from a crucial multi-year resistance level around $3.6k.

Source: X

For as long as Ether price maintains above the support level of $3k, a potential reversal is likely in the coming days towards a new all-time high. The midterm bullish outlook is favored by the rising fear of crypto capitulation amid notable deleveraging of long traders.

Furthermore, the crypto market often tends to move in the opposite direction to the crowd’s sentiment. Meanwhile, the Bitcoin OG whale, who has successfully traded in the recent past including the recent crypto crash, has longed BTC and Ether with $37 million and $18 million respectively.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.