Bitcoin Hits $116,000 – Here’s Why This Bull Run Is Different

Bitcoin surged to an all-time high of $116,000 on July 10, just six days after Donald Trump signed the Big Beautiful Bill into law. The flagship cryptocurrency has gained 6% since the bill’s signing, with Ethereum and other altcoins following close behind.

The rally comes amid a wave of macroeconomic shifts, rising US debt, tightening bond markets, and historic ETF inflows.

Fiscal Surge Triggers Flight to Hard Assets

Trump’s $3.3 trillion Big Beautiful Bill, signed on July 4, triggered an immediate $410 billion rise in US debt. The bill lifts the debt ceiling by $5 trillion and permanently extends key tax cuts.

Markets see this as inflationary. Investors are rotating out of bonds and into scarce assets like Bitcoin. The bill’s size and speed of implementation have amplified fears over fiscal discipline.

Bitcoin, with its fixed supply, is emerging again as a hedge against fiat debasement.

BlackRock’s spot Bitcoin ETF (IBIT) has reached $76 billion in assets under management. That’s triple what it held just 200 trading days ago.

By comparison, it took the largest gold ETF over 15 years to reach the same milestone. Institutional flows are now a powerful driver of price action, pushing Bitcoin deeper into mainstream portfolios.

Fed Balance Sheet Shrinkage Tightens Liquidity

In June, the Federal Reserve reduced its balance sheet by $13 billion, bringing it to $6.66 trillion—the lowest since April 2020. The Fed has now cut over $2.3 trillion in assets over the last three years.

Meanwhile, Treasury holdings are down $1.56 trillion in that same period. With fewer buyers in the bond market and more debt being issued, investors are moving into alternative stores of value.

Bitcoin has become the top candidate.

Also, Ethereum is trading near $3,000, up 14% since the Big Beautiful Bill became law. Solana, Avalanche, and other altcoins are also rallying.

Retail and institutional capital are returning. Meme coins and DeFi tokens are gaining traction as speculative sentiment returns. Crypto is once again leading the risk-on cycle.

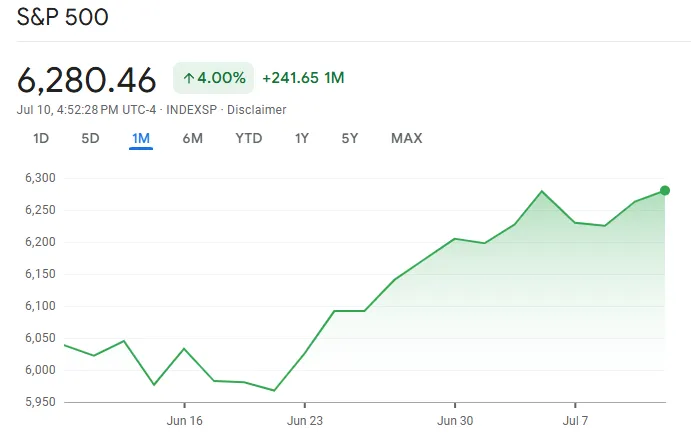

S&P 500 All-Time High: Risk-On Across the Board

The S&P 500 has surged 30% since its April 2025 low, hitting a new all-time high this week. This signals strong investor confidence in high-growth, high-risk assets.

Bitcoin benefits directly from this environment. As equities rally, crypto tends to follow. The market sees the Big Beautiful Bill as indirect stimulus—and it’s responding accordingly.

Bottom Line

Bitcoin’s latest all-time high is a response to structural changes—not hype. The Big Beautiful Bill expanded the deficit and shook confidence in US debt markets.

With inflation fears rising and institutional access growing, Bitcoin is becoming the macro hedge of choice. As crypto enters a new bull market, all eyes now turn to the Federal Reserve and rate cut decisions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.