Bitcoin Miners Now ‘Extremely Underpaid’: Ticking Time Bomb?

On-chain data suggests the Bitcoin miners are currently quite underpaid. Could this trigger a selloff from these chain validators?

Bitcoin Miners Are Extremely Underpaid According To This Model

As pointed out by analyst IT Tech in a CryptoQuant Quicktake post, the Miner Profit/Loss Sustainability has recently seen a sharp negative spike for Bitcoin. The “Miner Profit/Loss Sustainability” refers to an on-chain indicator that compares miner revenue with mining difficulty.

When the value of the metric is highly positive, it means the miners are earning a high income relative to the difficulty level imposed by the blockchain for mining new blocks. Such a trend can imply that these chain validators may be becoming overpaid.

On the other hand, the indicator being deep in the negative region can suggest miners may be underpaid as they are pulling in a low revenue despite high difficulty.

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin Miner Profit/Loss Sustainability over the past year:

The value of the metric appears to have seen a sharp negative spike in recent days | Source: CryptoQuant

As displayed in the above graph, the Bitcoin Miner Profit/Loss Sustainability has witnessed a plunge deep into the red zone, a sign that miner revenue has dropped relative to the difficulty.

The indicator is now flashing an ‘extremely underpaid’ signal for the miners. Historically, whenever the miners are under financial pressure, they participate in some selling to keep the electricity bills paid. Given the current state of this cohort, it’s possible that BTC could soon face elevated selling pressure from them.

So far, miner selling has actually trended down, as the trend in another indicator suggests.

Looks like the value of the metric has been sliding down | Source: CryptoQuant

The chart shows the log-scaled data of the Bitcoin Miner Selling Power, an indicator that measures the ratio between BTC miner outflows (that is, the amount going out of their wallets) against their total holdings.

It would appear that the metric has recently been sharply moving down, a potential indication that miners have been participating in reduced selling relative to their reserves. Considering the pressure that these chain validators are under, however, it only remains to be seen how long this balance lasts.

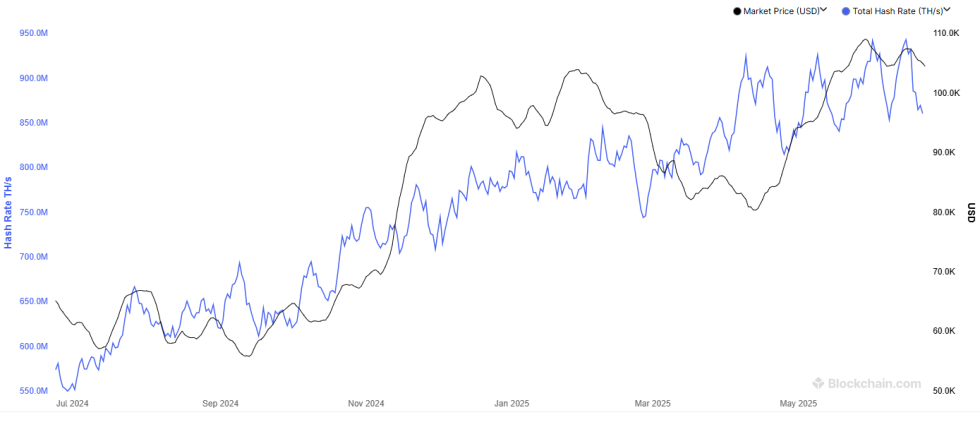

In some other news, the total amount of computing power employed by the miners, the “Hashrate,” has crashed, as the 7-day average data of the metric shows.

The trend in the BTC Hashrate over the past twelve months | Source: Blockchain.com

Earlier in the month, the Bitcoin Hashrate rose to a new all-time high (ATH) earlier in the month, but has plummeted since then, meaning that the miners haven’t been able to sustain their upgrades, providing another confirmation of the pressure the miners are under.

BTC Price

Bitcoin crashed close to the $98,000 mark yesterday, but its price has since jumped back up to $101,100.

The price of the coin appears to have plummeted | Source: BTCUSDT on TradingView

Featured image from Dall-E, Blockchain.com, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.