Bitcoin Bulls Eye Dollar Weakness As Yen Intervention Rumors Build

Bitcoin traders are once again anchoring to FX, after intervention rumors around USD/JPY revived a familiar tug-of-war: short-term shock risk from a strengthening yen versus the longer-horizon bid that typically follows a softer dollar and easier global liquidity.

The spark over the weekend was a viral X thread (2.9 million views) from Bull Theory (@BullTheoryio), which framed reported “rate checks” by the Federal Reserve Bank of New York as a prelude to coordinated action. “The New York Fed has already done rate checks, which is the exact step taken before real currency intervention,” the account wrote. “That means the US is preparing to sell dollars and buy yen. This is rare. And historically, when this happens, global markets surge.”

Bitcoin In The Crosshairs

Bull Theory pointed to the macro backdrop in Japan, years of yen weakness, Japanese bond yields at multi-decade highs, and a still-hawkish Bank of Japan, as the pressure cooker forcing officials toward more aggressive signaling. In the thread’s telling, the key variable is coordination: Japan acting alone “does not work,” while joint US-Japan action “does,” citing 1998 and the Plaza Accord era as historical reference points.

A Bloomberg report cited by the account described the yen’s sharp jump on speculation that Japanese authorities could be preparing intervention to arrest the currency’s slide, after traders reported the New York Fed had conducted rate checks with major banks. The story said the yen rallied as much as roughly 1.6% to around 155.90 per dollar, marking its strongest level since December in that session.

🇺🇸 THE FED IS PREPARING TO SELL U.S. DOLLARS AND BUY JAPANESE YEN FOR THE FIRST TIME THIS CENTURY.

The New York Fed has already done rate checks, which is the exact step taken before real currency intervention. That means the U.S. is preparing to sell dollars and buy yen.

This… pic.twitter.com/7xFReOFoDo

— Bull Theory (@BullTheoryio) January 25, 2026

The fight in the replies was less about whether markets moved and more about what a “rate check” actually signals.

Daniel Kostecki (@Dan_Kostecki) dismissed the viral framing outright, arguing the mechanism is often misread. “The Japanese asked the NY Fed to act as their agent in the American market,” Kostecki wrote. “NY Fed employees then started calling banks in New York to perform the ‘rate check’—strictly at the Japanese’s request. If officials from Tokyo had called New York banks, traders might have ignored it as a ‘local Japanese problem.’ But when the Fed calls, banks treat it as a signal that a joint intervention (USA + Japan) might be coming.”

That distinction matters for crypto because the thread’s “bull case” leans heavily on the idea that selling dollars to buy yen mechanically weakens the dollar and expands liquidity, conditions many macro-focused crypto traders associate with risk-asset upside.

Ted (@TedPillows) echoed the liquidity-first interpretation while flagging the path dependency. “The Fed is preparing for a possible yen intervention,” he wrote, before laying out the causal chain: dollars sold, yen bought, dollar weaker, liquidity higher, risk assets helped, then warning that “a strengthening yen could first cause a similar crash like in August 2024.” After that, he added, markets could stabilize and rally.

Michael A. Gayed (@leadlagreport), Portfolio Manager of The Free Markets ETF, offered a different rationale for why Washington would care, suggesting the Fed is acting to prevent a scenario where Japan would need to sell US Treasuries to raise dollars to intervene—“It’s not that Japan will panic. It’s the Fed that will panic,” he wrote.

Bull Theory’s most concrete crypto claim was that the setup contains both a near-term trap and a medium-term tailwind. The account argued there are “hundreds of billions of dollars tied into the yen carry trade,” meaning abrupt yen strength can force deleveraging in the very assets, stocks and crypto, funded with cheap yen borrowing.

As an example, the account pointed to August 2024, claiming a small BoJ rate hike pushed the yen higher and “Bitcoin crashed from $64K to $49K in six days,” with crypto losing “$600B in value.” Bull Theory framed that episode as the template for the “catch” in 2026: yen strength can be toxic in the first act, even if sustained dollar weakness ultimately improves the liquidity backdrop for Bitcoin.

LondonCryptoClub (@LDNCryptoClub) leaned into that lagged-liquidity framing, arguing that a weaker dollar tends to filter into risk assets with a delay, while also introducing an additional US liquidity variable. “Continued and accelerated breakdown of the dollar will be good for Bitcoin and broad risk over the next few months,” the account wrote, adding that the dollar “tends to act with a 3 months lag” outside of “knee jerk reactions.” It also warned that a potential US government shutdown and subsequent Treasury General Account rebuild could offset some of the positive liquidity impulse.

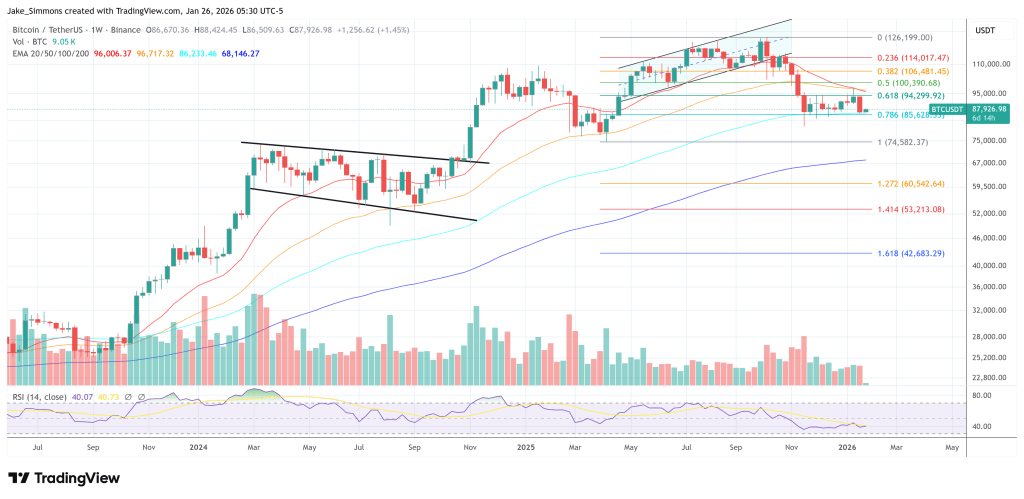

At press time, Bitcoin traded at $87,926.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.