$6 Billion BTC Inflows Drive Bitcoin Price Toward $100,000

Bitcoin surged sharply this week, climbing from roughly $91,000 on Monday to just above $95,000 by Wednesday. Meanwhile, on-chain data reveals a massive influx of BTC into major exchange wallets.

The dramatic price action has sparked discussions, with some speculating that the market may be experiencing a coordinated buying push.

Sponsored

Sponsored

Massive $6 Billion BTC Inflows Drive Bitcoin Toward $100,000

Data from on-chain analytics firm Arkham shows that Binance wallets alone added 32,752 BTC across both cold and hot wallets, while Coinbase saw an increase of 26,486 BTC.

Smaller exchanges also recorded notable inflows, with Kraken and Bitfinex adding 3,508 BTC and 3,000 BTC, respectively. In total, these movements represent roughly $6 billion in combined buying power, according to Arkham.

The scale of these transfers has fueled debate about whether the recent price surge was driven by coordinated market activity. Binance CEO Changpeng Zhao addressed the speculation, clarifying that the BTC deposits reflected user purchases on exchange wallets rather than internal buys by the exchange itself.

Despite this clarification, analysts say the data indicate a strong wave of institutional and high-net-worth investor participation.

Sponsored

Sponsored

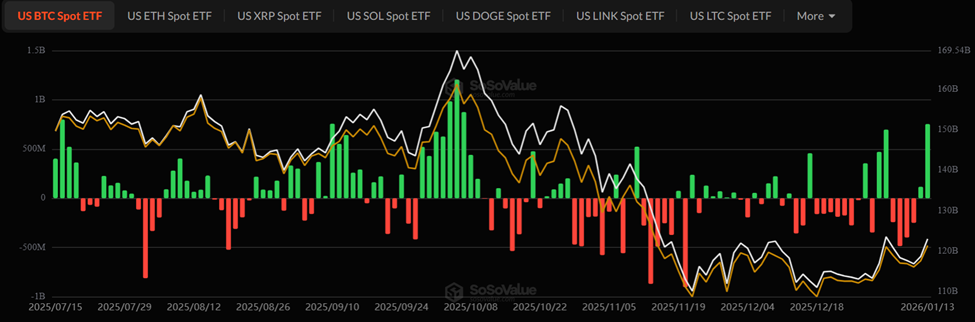

It comes just after Bitcoin ETF inflows reached levels last seen in October 2025, as investments into the financial instrument reached $753 million on Tuesday, January 13.

Fidelity’s FBTC led Tuesday’s inflows, reaching $351 million, and marking one of the strongest single-day demand signals for institutional BTC exposure this year.

Is $100,000 Next for Bitcoin Price?

With $100 on the cards for the Silver price, likewise, Bitcoin is also racing to $100,000, accentuated by the latest buying activity and broader bullish sentiment in the crypto market.

Bitcoin’s ascent toward the $100,000 mark comes as investors weigh macroeconomic factors, including inflation trends and central bank liquidity measures, alongside developments in the broader digital asset ecosystem.

The surge reinforces Bitcoin’s appeal as a long-term store of value amid financial uncertainty and geopolitical chaos.

Arkham’s data points to a concentration of activity among major exchanges, which often serve as the primary gateway for institutional buying.

Such inflows historically precede notable price rallies, reflecting both increased demand and constrained supply in the market. However, while the scale of purchases is significant, crypto markets remain volatile, and sudden reversals are always possible.